Why Fall/Winter of 2024 may be the time to buy a house?

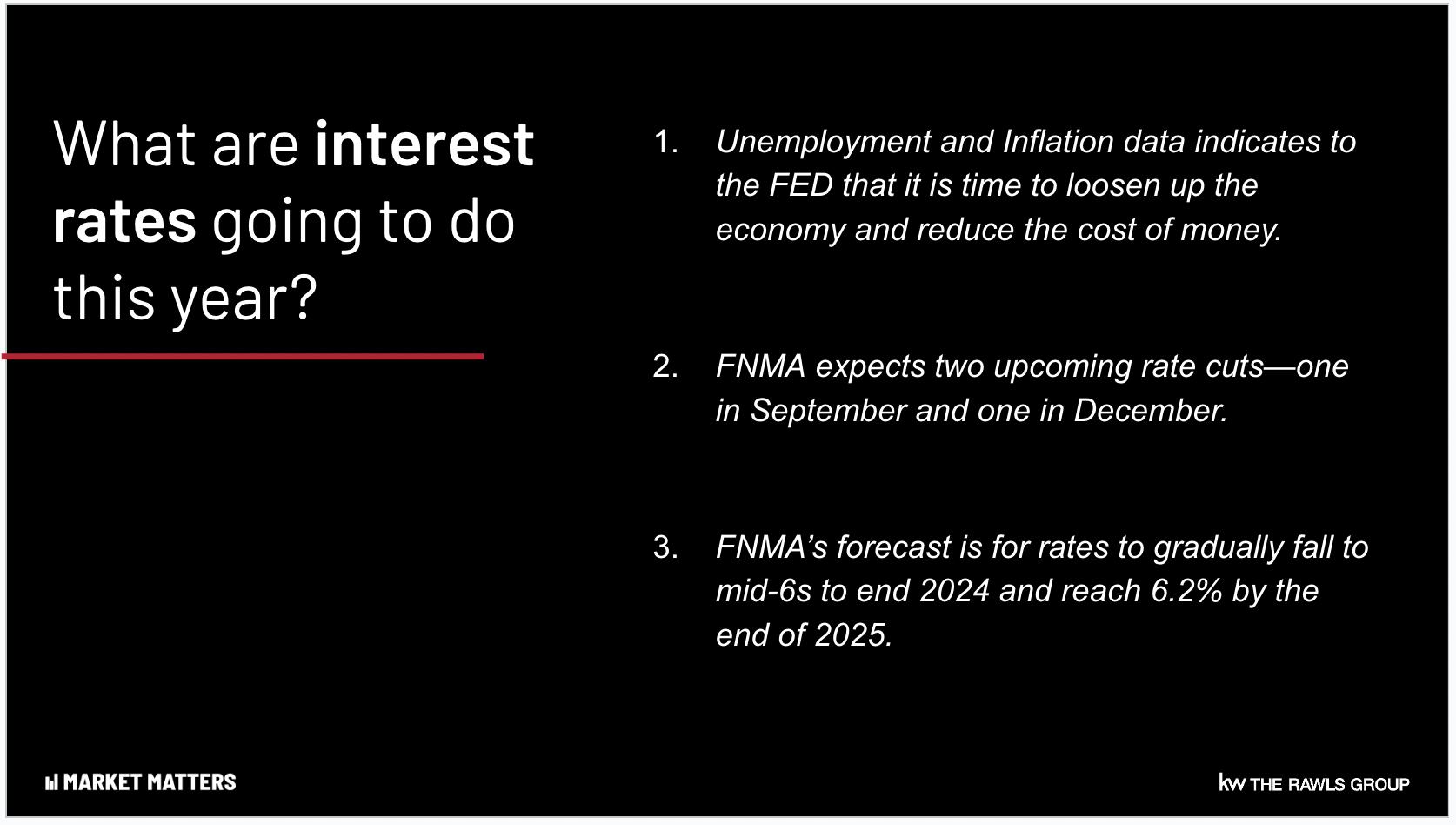

If you pay attention to the Real Estate market at all you’ll know that those 2% interest rates that we saw back in 2020-2021 are long gone and rates have been holding steady around 6.8-7% for a while now. This has made many buyers hesitant to make a move that they may have made if the rates were lower.

I’m going to make the case that buying now is actually a great time to be a buyer.

First – there’s a saying in real estate that has been used for years…

Date the rate, Marry the house.

What does this mean? This means that if you want (or need!) to move, your primary focus should be on the house and finding the house that checks the most boxes for you…and if the rate is high, you can always refinance when the rates come down.

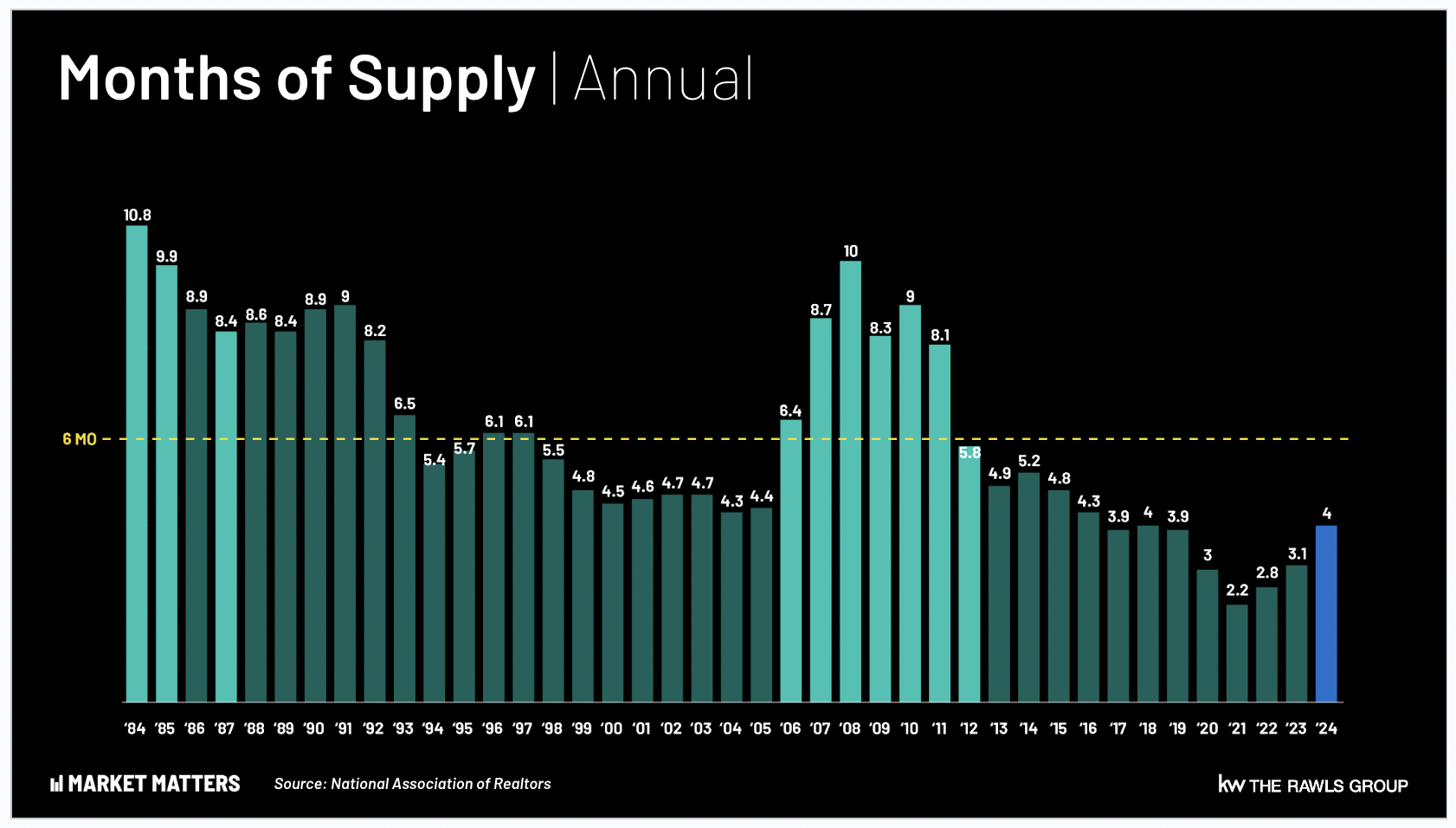

Secondly – housing inventory is higher right now that it has been since 2019 according to the National Association of Realtors. So we have rising inventory and fewer buyers in the market because of rates. What does this mean? This means you have more to choose from AND you have a better chance of getting a better price for a house! It’s important to note that 6 months of inventory is considered an “even” market so we are still in a slight sellers’ market, but there’s more to choose from now than there has been for years.

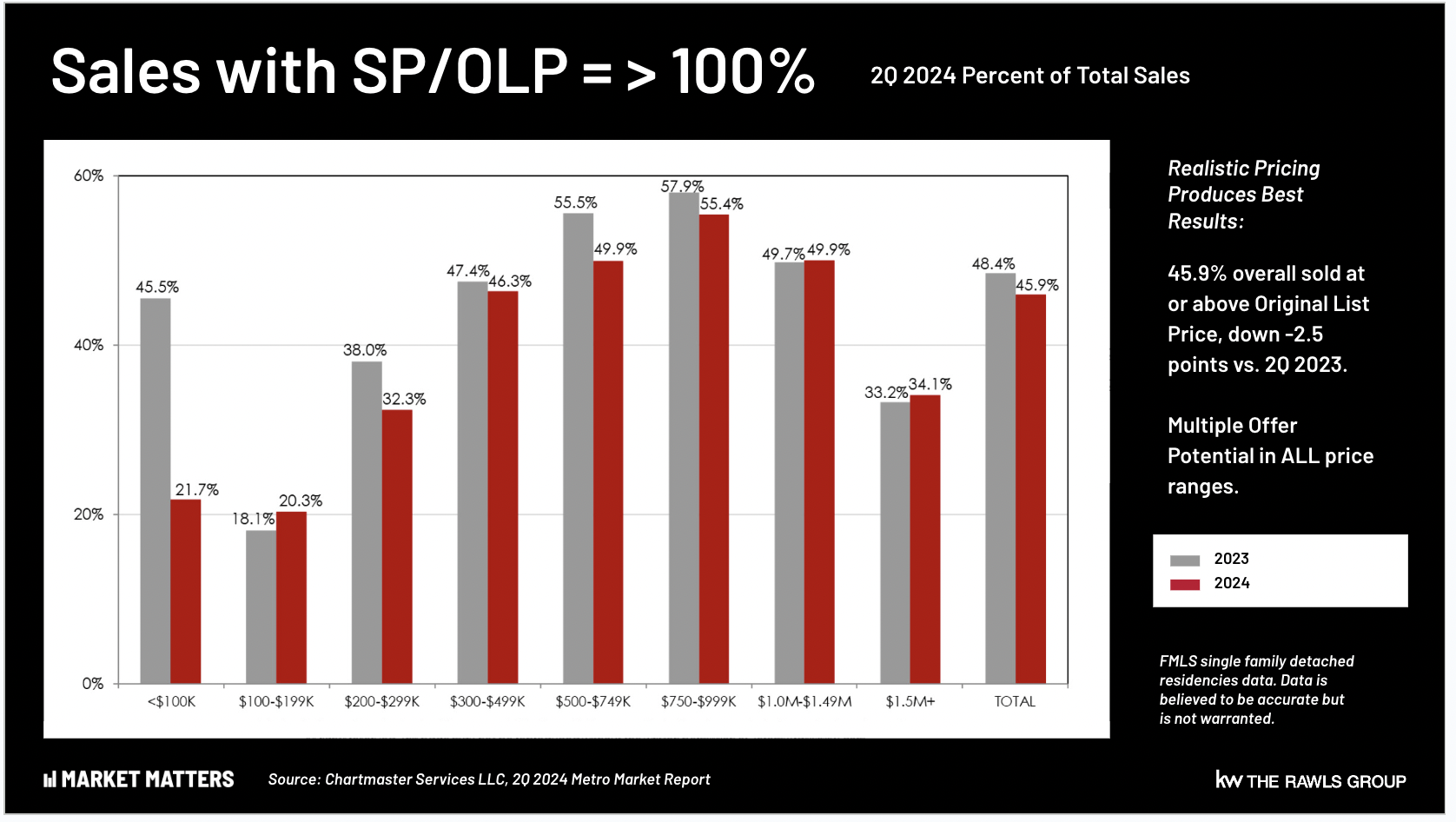

Don’t take our word for it! Look at what’s going on with prices in Metro Atlanta. The graph below shows the percentage of houses that sold AT or above the asking price for 2023 (grey) and 2024 (red). This number in almost every price range has decreased.

Now let’s talk about the predictions for interest rates:

As rates come down, more and more buyers will re-enter the marketplace which will bring more competition (again) between buyers.

So, let’s say you buy now. You’ve bought at a higher rate, yes, but because there’s not as much competition and increasing inventory so maybe you are able to negotiate a lower price than the asking price. This is not always the case, but as you see in the graph above it’s happening more and more. In any case, you’ve bought a house at TODAY’S price. Housing prices are more-than-likely going to continue increasing. 2 years from now you’re in your home (with some equity!) and can refinance to the lower rate.

Everyone’s situation is different. If you’re even thinking about buying, selling or both, we can sit down and have an in-depth consultation with you to discuss what may be the best course of action for you!